News

Tax-free investments and free government money for children

One of the easiest ways to grow a large investment is to start early.

There are a variety of ways to invest for children depending on their age and how much control the family want to have. We have covered the most common options below. With all four, the money can either be held in cash or invested in assets that will go up and down, such as the stock markets:

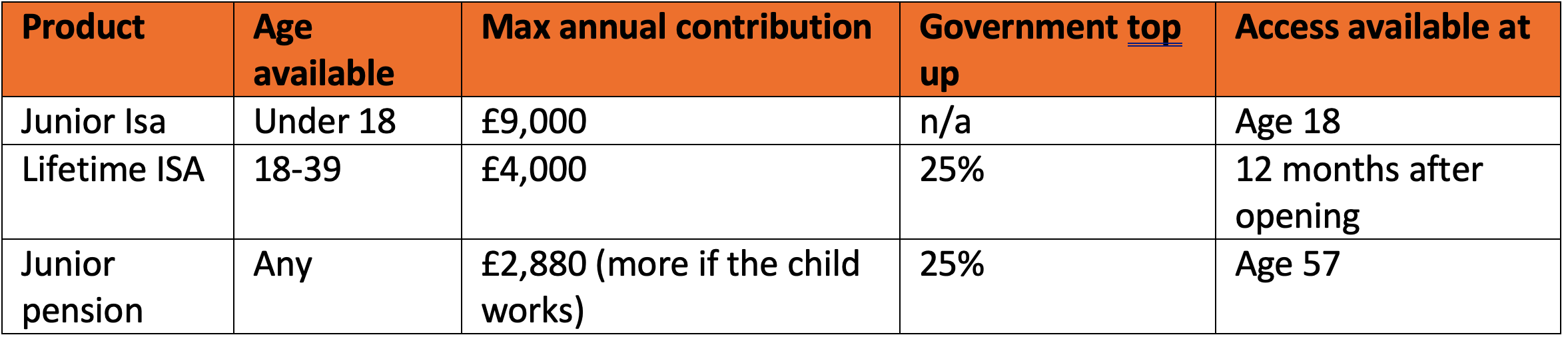

Junior ISA

- Like an adult ISA

- Available for a child under 18

- Up to £9,000 can be added each tax year

- The child can control the account from age 16 but cannot withdraw money until age 18

- No tax on any aspect of a Junior ISA, including withdrawals

Lifetime ISA

- For their first property

- Can be opened by anyone aged 18 to 39

- Up to £4,000 can be added each tax year

- The government then adds 25% to each contribution so subscribe the full £4,000 a year and the child gets another £1,000 on top, totally free

- No tax on any aspect of a Lifetime ISA, including withdrawals

- The money must be used to either:

- To help buy the child’s first property as long it’s worth less than £450,000. The Lifetime ISA must have been open for at least 1 year

- For spending in retirement, in which case it can only be accessed after age 60

- There are penalties if money is used for any other purpose

Junior pension

- For retirement

- Available for a child under 18

- Up to £2,880 can be added each tax year.

- The government then add 25% to each contribution so add £2,880 and the child gets another £720 on top

- The child will not be able to access the money until age 57

- When it is accessed, 25% of the money is available tax-free with the remainder being subject to income tax

Trusts

- The family can keep control

- Can be set up for a child (or multiple children or adults) of any age

- No restriction as to how much can be added although there can be tax to pay in some circumstances e.g. if large six-figure amounts are added to certain types of trust

- Ongoing tax is more complex than the options above and depends on the specific type of trust

- The money is owned by the trust i.e. not the family or the child

- There are several types of trust but typically, the principal is that they allow the family to move money out of their name whilst retaining control over when the child can access it.

- Often involves working with a financial planner and solicitor to ensure they are set up appropriately

If you would like to have a coffee and a chat to discuss how best to set up your child(ren) financially, please get in touch to arrange a face-to-face, video or phone meeting with us.

The value of investments and the income derived from them can fall as well as rise. You may not get back what you invest.

This communication is for general information only and is not intended to be individual advice. It represents our understanding of law and HM Revenue & Customs practice. You are recommended to seek competent professional advice before taking any action.

Tax and Estate Planning Services are not regulated by the Financial Conduct Authority.

Sign-up for our Carbon Catch-Up Newsletter

Part of The Progeny Group

Progeny is independent financial planning, investment management, tax services, property, HR and legal counsel, all in one place.

Carbon Financial Partners, part of The Progeny Group, is a trading name of Carbon Financial Partners Limited which is authorised and regulated by the Financial Conduct Authority under reference 536900.

Carbon Financial Partners Limited is registered in Scotland. Company registration number SC386400. Registered Address: 61 Manor Place, Edinburgh, EH3 7EG. Carbon Financial Partners Limited is part of The Progeny Group Limited.

© Carbon Financial Partners 2026

www.financial-ombudsman.org.uk

Client Account | Personal Finance Portal | Privacy Notice | Cookies | Careers