News

Charting your way through choppy waters

If investing was easy, with no risk or uncertainty then there would be no premium for doing so. We’d all just stick to cash, keeping all of our money in the bank, or worse still, under the mattress.

But, as we’ve all experienced in the past few years and beyond, risk and uncertainty are almost ever- present. So, rather than being consumed or even paralysed by fear when investment markets take a downturn, we should be kind to ourselves and accept that this is simply part of the life-long journey to investment success.

Bear markets and downturns are simply a fact of life. There have been 9 in the UK in the last 50 years, so for anyone reading this that is now in retirement, you’ve lived through most of these and are still here to tell the tale. The tale is ‘stay in your seat’ and be laser-focused on the long-term goal, which for most is to beat cash returns and inflation to protect the purchasing power of your hard-earned money. Time, discipline and patience are your biggest allies.

When markets fall sharply, capitulating, or selling your holdings is not the answer. Falls of 20% or more denote a bear market, but these are normally followed by a period of prolonged growth which you would have missed out on if you had sold your holdings on the way down.

Countless claims have been made by active investment managers that they can predict which companies will out-perform over the long run and when to buy into markets and when to sell. The data on their success rates is damning. Just under 7 in 100 global equity managers survives for 10 years and beats the index they invest in (source: SPIVA Europe Scorecard Year-End Highlights 2022).

They fail, partly because timing the market is extremely difficult. The best and worst trading days have often come hot of the heels of each other, during times of significant market turmoil. In fact, more than half of the best trading days in the UK stock market in the last 40+ years have come during years that delivered a negative return. This means that the cost of getting it wrong is high. Staying in your seat after a fall means you are still there to enjoy the bounce back, which can be very powerful.

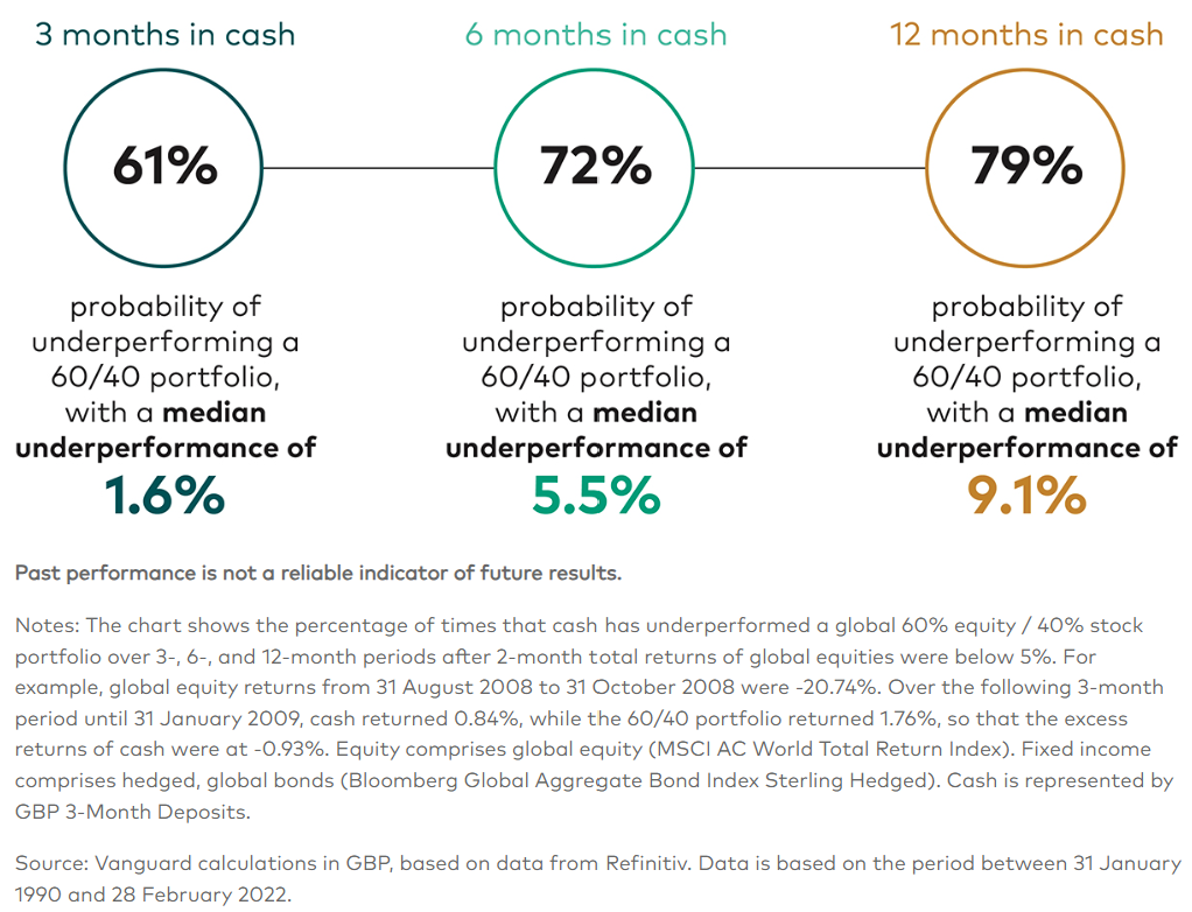

For an investor with a portfolio 60% invested in equities and 40% in fixed interest, selling up and retreating to cash after a fall in value of only 5% in global equities leads to sub-optimal returns, which worsen the longer you stay in cash. Selling up is only one of two decisions you have to get right to win at the market-timing game. You also need to know when to go back in. The longer you leave it, the worse the outcome. Much easier and more efficient to just stay invested and not get caught up in all the ‘noise’ surrounding market falls. They are a permanent and expected feature of investing, so we should just get used to it and we’d all sleep easier and worry less. It’s a classic ‘no pain, no gain’ scenario.

In summary, the not-so secret rules for investment success are;

- Have a financial plan and a robust investment strategy you can stick to, ignoring the ‘noise’.

- Accept that market falls, and sometimes prolonged periods of relatively poor returns are part and parcel of the journey. They are expected, so don’t be surprised or disheartened when they occur.

- Diversify your portfolio across as many asset classes and holdings as possible for a smoother investment experience.

- Control the controllables, with costs being the principal thing you have control over.

If you would like to learn more about how Carbon can help you, please get in touch.

The value of investments and the income derived from them can fall as well as rise. You may not get back what you invest.

This communication is for general information only and is not intended to be individual advice. It represents our understanding of law and HM Revenue & Customs practice. You are recommended to seek competent professional advice before taking any action.

Tax and Estate Planning Services are not regulated by the Financial Conduct Authority

Sign-up for our Carbon Catch-Up Newsletter

Part of The Progeny Group

Progeny is independent financial planning, investment management, tax services, property, HR and legal counsel, all in one place.

Carbon Financial Partners, part of The Progeny Group, is a trading name of Carbon Financial Partners Limited which is authorised and regulated by the Financial Conduct Authority under reference 536900.

Carbon Financial Partners Limited is registered in Scotland. Company registration number SC386400. Registered Address: 61 Manor Place, Edinburgh, EH3 7EG. Carbon Financial Partners Limited is part of The Progeny Group Limited.

© Carbon Financial Partners 2026

www.financial-ombudsman.org.uk

Client Account | Personal Finance Portal | Privacy Notice | Cookies | Careers