News

Intermediate tax payers – will you claim your 1%?

In February, the Scottish government rubber-stamped proposals for a radical shake up to Scottish rates of income tax.

One of the largest groups affected is the 800,000+ Scots who, from April 2018, will pay income tax at a new intermediate rate of 21%. This will be paid on earnings between £24,000 and £43,430.

HMRC has moved very swiftly to confirm that those in the intermediate band will continue to receive 20% ‘basic rate’ tax relief on pension contributions, at source.

What about the extra 1%? I hear you cry

Worry not. HMRC has also confirmed that Scottish intermediate tax payers are entitled to reclaim the extra 1%, but they must do so through self-assessment or by contacting HMRC. Now, I’m not suggesting that all 800,000+ intermediate tax payers will be currently paying into pensions, but that is still going to be a significant number of people who will need to take action to receive their full entitlement to pension tax relief.

Groan. Is it worth the hassle?

Well, let’s say you are near the top of the band, with a £40,000 a year salary and you make a 5% of salary pension contribution. The contribution costs you £1,600 net, with 20% basic rate relief of £400 topping up the contribution to £2,000 gross.

The additional 1% equates to £20. Reclaiming this over a working life of say 30 years would net you around £1,000 (factoring in pay rises in line with inflation). Will this be enough to motivate thousands of people to contact HMRC or to complete a tax return for the first time, or will thousands of pounds go unclaimed and remain in the Government’s coffers?

Finally, don’t worry if your total earnings are in the new 19% starter rate band (£11,850 – £13,850), HMRC will continue to provide 20% pension tax relief at source and won’t seek the claw back the extra 1%. Phew!

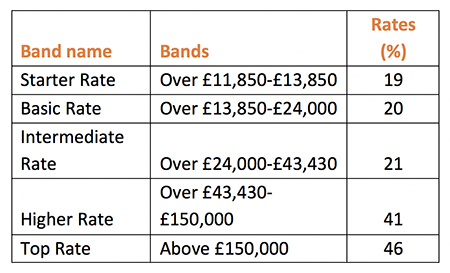

For general information: from April 2018 the following five-tier Scottish income tax system will take effect:

Stephen Rowntree is a Chartered Financial Planner at Carbon. For more information on how the new rates of Scottish income tax will affect your personal finances, please contact your usual planner or email Stephen on Stephen.rowntree@carbonfinancial.co.uk

Sign-up for our Carbon Catch-Up Newsletter

Part of The Progeny Group

Progeny is independent financial planning, investment management, tax services, property, HR and legal counsel, all in one place.

Carbon Financial Partners, part of The Progeny Group, is a trading name of Carbon Financial Partners Limited which is authorised and regulated by the Financial Conduct Authority under reference 536900.

Carbon Financial Partners Limited is registered in Scotland. Company registration number SC386400. Registered Address: 61 Manor Place, Edinburgh, EH3 7EG. Carbon Financial Partners Limited is part of The Progeny Group Limited.

© Carbon Financial Partners 2024

www.financial-ombudsman.org.uk

Client Account | Personal Finance Portal | Privacy Notice | Cookies